On 1 October, the New Zealand Inland Revenue published a new 2024 edition of its Multinational Enterprises Compliance Focus.

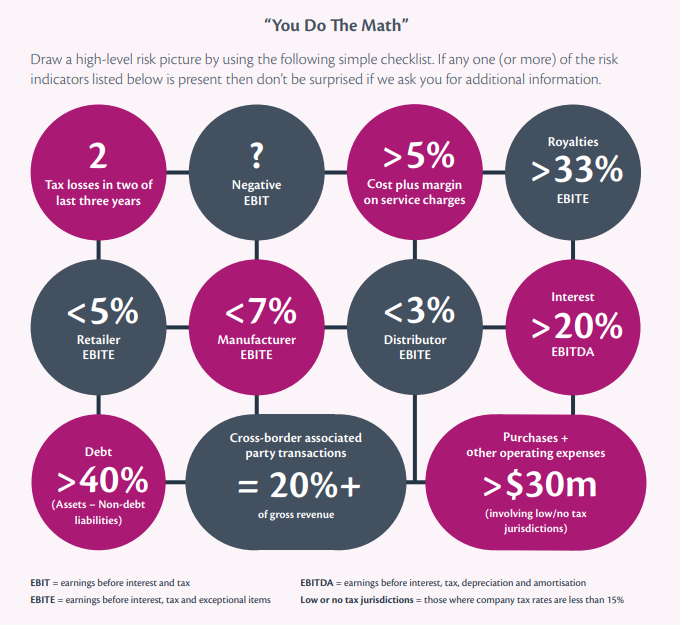

According to the publication (page 23), the provision of risk indicators will assist MNE’s in self-assessing their compliance with anti-BEPS measures and identifying potential deficiencies. A self-assessment can be conducted using the flowchart below.

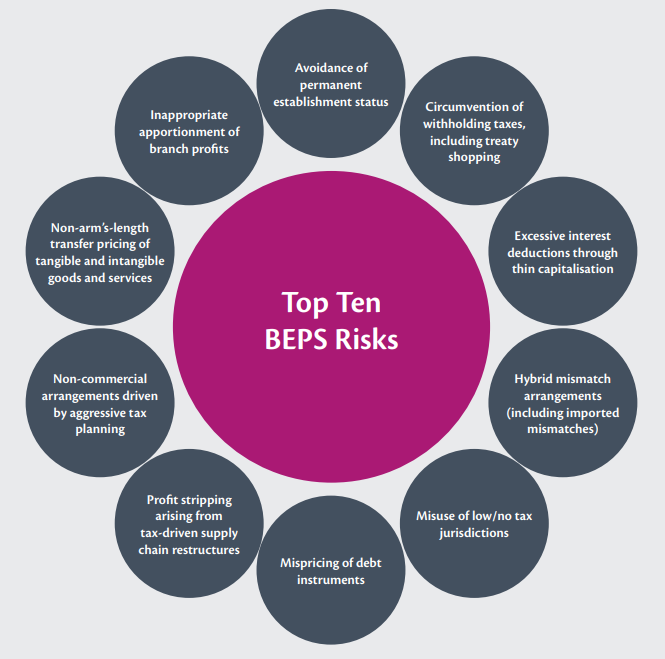

According to the publication (page 24), the top ten base erosion and profit shifting risks in New Zealand are

According to the publication (page 27), the Inland Revenue has conducted targeted BEPS campaigns focusing on specific sectors and issues, using a range of information from questionnaires and follow-up activities. The top ten key findings from these campains to be incorporated into risk assessment models and future interventions are

- Bundled intangible property (i.e. a single payment for several types of rights) is the highest risk category of intangible, as it is difficult to identify (and price) the individual elements with specificity.

- Geographic isolation and lack of competitive pressures lead to large MNEs dominating the New Zealand market and thus higher operating margins should result than most other markets.

- Global transfer pricing policies and associated target rates of return should not be applied in isolation but customised to New Zealand circumstances and specific results.

- Where losses have been incurred, detailed explanations as to how these have arisen as well as turnaround plans to return to profitability should be available.

- High risk arrangements such as the provision of intangible property and specialised services, complex financing arrangements and market support payments should be supported by inter-company agreements and transfer pricing documentation (including additional contextual explanations and analysis).

- Comparable data must be drawn from the same or similar markets as the New Zealand-tested party; it will generally involve reference to Australasian data. This is supported by both Governments’ commitments to a process called the Single Economic Market agenda, designed to create a seamless trans-Tasman business environment. Australia is recognised as our closest reference country in terms of demographics, size of economy and stage of economic development. In contrast, the use of data from large Asian economies (such as China, India, Japan and Korea) provides weak support for New Zealand tested party results as none of these are considered comparable to the New Zealand market.

- MNE distributors generally undertake more functions and hold higher inventory levels than those operating in other markets. The Berry ratio is not a reliable profit level indicator apart from cases involving basic service providers.

- Higher risk is associated with the application of the residual profit split method, as opposed to methods which rely upon market comparables; a cross-check using a secondary transfer pricing method is recommended to mitigate this higher risk.

- Sales to end-consumers require more sales and marketing investment along with higher levels of service and after-sales care; higher operating margins are expected due to this increased functionality.