TPcases

Database of Transfer Pricing Case Laws

- Keywords

- Countries

- Countries

- Albania

- Angola

- Argentina

- Australia

- Austria

- Azerbaijan

- Bahamas

- Bangladesh

- Belgium

- Bermuda

- Bosnia and Herzegovina

- Brazil

- Bulgaria

- Canada

- Cayman

- Chile

- China

- Colombia

- Costa Rica

- Croatia

- Cyprus

- Czech

- Denmark

- Dominica

- Ecuador

- Egypt

- El Salvador

- Estonia

- European Union

- Finland

- France

- Georgia

- Germany

- Greece

- Greenland

- Honduras

- Hong Kong

- Hungary

- Iceland

- India

- Indonesia

- Isle of Man

- Ireland

- Israel

- Italy

- Jamaica

- Japan

- Kazakhstan

- Kenya

- Korea

- Kosovo

- Labuan

- Latvia

- Liberia

- Liechtenstein

- Lithuania

- Luxembourg

- Malaysia

- Maldives

- Malta

- Mauritius

- Mexico

- Netherlands

- New Zealand

- Nigeria

- Norway

- Pakistan

- Panama

- Papua New Guinea

- Paraguay

- Peru

- Philippines

- Poland

- Portugal

- Puerto Rico

- Romania

- Russia

- Saudi Arabia

- Senegal

- Seychelles

- Singapore

- Slovakia

- Slovenia

- South Africa

- Spain

- Sri Lanka

- Sweden

- Switzerland

- Taiwan

- Tanzania

- Thailand

- Tunisia

- Türkiye

- Uganda

- Ukraine

- United Arab Emirates

- United Kingdom

- Uruguay

- United States

- Zimbabwe

- OECD

- UN

- G20

- Guidelines

- OECD Transfer Pricing Guidelines 2022

- OECD Transfer Pricing Guidelines 2017

- OECD Transfer Pricing Guidelines 2010

- OECD Transfer Pricing Guidelines 2009

- OECD Transfer Pricing Guidelines 1995

- OECD Transfer Pricing Guidelines 1979

- OECD Model Tax Convention 2017

- UN Manual on Transfer Pricing 2021

- UN Model Double Tax Convention 2017

- Case Laws

- Arm's Length Principle

- Benchmark, Range and Median

- Beneficial Owner

- Burden of Proof

- Business Restructuring

- Commodity Transactions

- Comparability Analysis

- Cost Contribution Arrangements

- Delineation - Substance over Form

- Digital Economy

- Disallowed Deduction

- EU State Aid

- Financial Transactions

- General Anti-Avoidance Rules

- Intangibles - Goodwill Know-how Patents

- Legal and Constitutional Issues

- Losses

- Non-Recognition and Recharacterisation

- Permanent Establishments

- Royalty and License Payments

- Marketing and Procurement Hubs

- Series of Related Transactions

- Services and Fees

- Shares and Dividends

- Tax Avoidance Schemes

- Tax Treaty Interpretation

- Transfer Pricing Documentation

- Transfer Pricing Methods

- Valuation - DCF and CUT/CUPs

- VAT and Customs Valuation

- Withholding Tax (WHT)

- TP News

- Keywords

- Countries

- Countries

- Albania

- Angola

- Argentina

- Australia

- Austria

- Azerbaijan

- Bahamas

- Bangladesh

- Belgium

- Bermuda

- Bosnia and Herzegovina

- Brazil

- Bulgaria

- Canada

- Cayman

- Chile

- China

- Colombia

- Costa Rica

- Croatia

- Cyprus

- Czech

- Denmark

- Dominica

- Ecuador

- Egypt

- El Salvador

- Estonia

- European Union

- Finland

- France

- Georgia

- Germany

- Greece

- Greenland

- Honduras

- Hong Kong

- Hungary

- Iceland

- India

- Indonesia

- Isle of Man

- Ireland

- Israel

- Italy

- Jamaica

- Japan

- Kazakhstan

- Kenya

- Korea

- Kosovo

- Labuan

- Latvia

- Liberia

- Liechtenstein

- Lithuania

- Luxembourg

- Malaysia

- Maldives

- Malta

- Mauritius

- Mexico

- Netherlands

- New Zealand

- Nigeria

- Norway

- Pakistan

- Panama

- Papua New Guinea

- Paraguay

- Peru

- Philippines

- Poland

- Portugal

- Puerto Rico

- Romania

- Russia

- Saudi Arabia

- Senegal

- Seychelles

- Singapore

- Slovakia

- Slovenia

- South Africa

- Spain

- Sri Lanka

- Sweden

- Switzerland

- Taiwan

- Tanzania

- Thailand

- Tunisia

- Türkiye

- Uganda

- Ukraine

- United Arab Emirates

- United Kingdom

- Uruguay

- United States

- Zimbabwe

- OECD

- UN

- G20

- Guidelines

- OECD Transfer Pricing Guidelines 2022

- OECD Transfer Pricing Guidelines 2017

- OECD Transfer Pricing Guidelines 2010

- OECD Transfer Pricing Guidelines 2009

- OECD Transfer Pricing Guidelines 1995

- OECD Transfer Pricing Guidelines 1979

- OECD Model Tax Convention 2017

- UN Manual on Transfer Pricing 2021

- UN Model Double Tax Convention 2017

- Case Laws

- Arm's Length Principle

- Benchmark, Range and Median

- Beneficial Owner

- Burden of Proof

- Business Restructuring

- Commodity Transactions

- Comparability Analysis

- Cost Contribution Arrangements

- Delineation - Substance over Form

- Digital Economy

- Disallowed Deduction

- EU State Aid

- Financial Transactions

- General Anti-Avoidance Rules

- Intangibles - Goodwill Know-how Patents

- Legal and Constitutional Issues

- Losses

- Non-Recognition and Recharacterisation

- Permanent Establishments

- Royalty and License Payments

- Marketing and Procurement Hubs

- Series of Related Transactions

- Services and Fees

- Shares and Dividends

- Tax Avoidance Schemes

- Tax Treaty Interpretation

- Transfer Pricing Documentation

- Transfer Pricing Methods

- Valuation - DCF and CUT/CUPs

- VAT and Customs Valuation

- Withholding Tax (WHT)

- TP News

Transfer Pricing News

Australian Draft Guideline on Financing Arrangements – PCG 2025/D2

The Australian Taxation Office’s draft Practical Compliance Guideline PCG 2025/D2 explains how the ATO assesses the tax risk of inbound cross-border related-party financing arrangements and the factors it takes into account. It also sets out the compliance framework the ATO follows when determining the appropriate interest rate or other pricing for such arrangements. Because the document is still in draft form, it has no effect until it is finalised. When issued, it will apply exclusively to inbound cross-border related-party financing arrangements ...

Common Errors made in Country-by-Country reports

On 23 May 2025, the OECD issued guidance on common errors made by multinational enterprise (MNE) groups when preparing their country-by-country (CbC) reports. These reports contain valuable information on the global allocation of income, taxes paid, and the location of economic activity among the tax jurisdictions in which an MNE group operates. This information can be used for a high-level transfer pricing risk assessment, the assessment of other BEPS-related risks, and economic and statistical analysis, if appropriate. However, this information can only be used effectively for these purposes if the ...

Germany’s new record keeping obligation – Transaction Matrix

Germany has issued guidance on a recent addition to German taxpayers’ transfer pricing documentation obligations. The transaction matrix now required under Section 90 (3) sentence 2 no. 1 AO is a structured, tabular overview of relevant information on the taxpayer’s transactions and business relationships with related parties and permanent establishments, which is intended to support risk-oriented case and audit field selection. Click here for an unofficial English Translation ...

Germany – Updated Administrative Principles on Transfer Pricing 2024

12 December 2024, the German Federal Ministry of Finance published updated administrative principles on transfer pricing 2024 (VWG VP 2024). The updates mainly concern the chapter on financial transactions, where paragraphs 3d and 3e have recently been added to the AStG. Paragraph 3d concerns the determination of arm’s length interest rates, group or stand-alone rating and whether capital should be treated as a loan or equity, and paragraph 3e concerns the treatment of financing arrangements, i.e. cash pools, hedging, etc. New guidance is also provided on the application of OECD ...

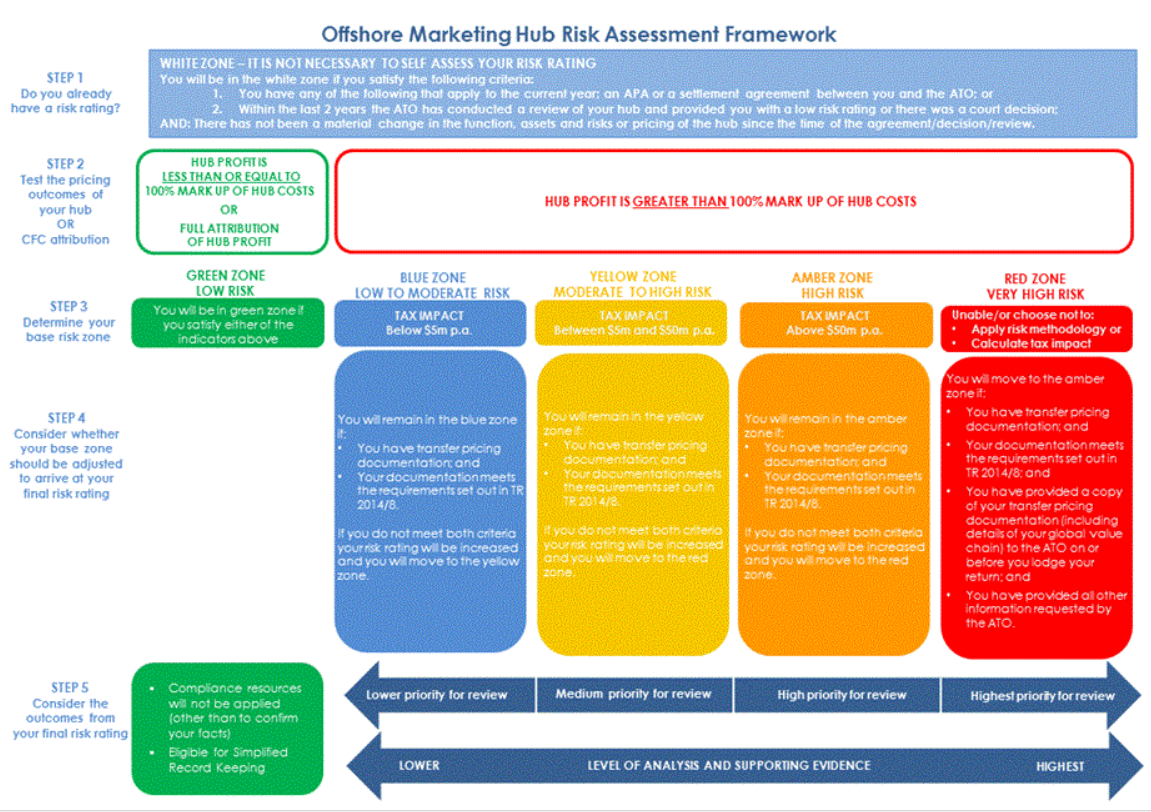

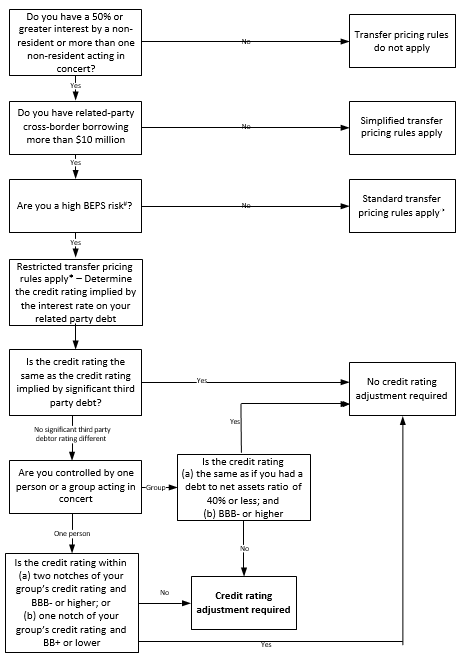

Inland Revenue of New Zealand – Multinational Enterprises Compliance Focus 2024

1 October 2024, the New Zealand Inland Revenue published a new 2024 edition of its Multinational Enterprises Compliance Focus. According to the publication (page 23), the provision of risk indicators will assist MNE’s in self-assessing their compliance with anti-BEPS measures and identifying potential deficiencies. A self-assessment can be conducted using the flowchart below. According to the publication (page 24), the top ten base erosion and profit shifting risks in New Zealand are According to the publication (page 27), the Inland Revenue has conducted targeted BEPS campaigns focusing on specific sectors ...

Peru – SUNAT guidance on pricing of intra-group services and application of the benefit test

9 September 2024, the Peruvian tax authority – SUNAT – issued guidance on the qualification of services, transfer pricing methods for services and the application of the “benefit test”. Click here for English translation ...

Statement from the Inland Revenue of New Zealand on Withholding Taxes arising from Transfer Pricing Arrangements

30 August 2024 the Inland Revenue of New Zealand issued Commissioner’s Statement CS 24/02. The Statement that sets out the Commissioner’s position in relation to the withholding tax obligations that may arise from transactions that constitute a transfer pricing arrangement ...

ATO seeks special leave to appeal the Full Federal Court’s PepsiCo-decision to the High Court

The Australian Tax Office (ATO) has applied for special leave to appeal to the High Court of Australia against the Full Federal Court’s decision in PepsiCo, Inc. v Commissioner of Taxation [2024] FCAFC 86. At issue was the ‘royalty-free’ use of intangible assets under an agreement whereby PepsiCo Singapore sold concentrate to Schweppes Australia. According to the ATO, part of the payments made by Schweppes Australia to PepsiCo Singapore were in fact royalties for the use of trademarks and trade names, which were subject to Australian withholding taxes. See also ATO’s ...

Airbnb Challenges IRS’ $4 billion assessment in U.S. Tax Court – Petition Filed in July 2024

In 2013, Airbnb entered into a technology and licensing agreement with its Irish subsidiary, which included a cost-sharing arrangement for the use and development of its proprietary intellectual property. As part of this arrangement, the Irish affiliate made a lump-sum platform contribution transaction (PCT) payment of $35 million in exchange for rights to Airbnb’s IP. To determine the PCT amount, Airbnb applied the income method, using discount rates ranging from 25% to 35% and estimating the useful lives of the licensed intangibles. The U.S. Internal Revenue Service (IRS) challenged this ...

OECD releases lists of qualifying and covered jurisdictions under Amount B

On 17 June 2024, additional guidance and lists of qualifying and coverred jurisdictions under Amount B was released by the OECD. The additional guidance includes: The definitions of qualifying jurisdictions within the meaning of section 5.2 and 5.3 of the Amount B guidance. These definitions will facilitate adjustments to the return calculated under the simplified and streamlined approach for tested parties located in those qualifying jurisdictions. The respective definitions are now incorporated into the Amount B guidance in the annex to Chapter IV of the OECD Transfer Pricing Guidelines. The definition of ...

Germany adds new TP-Provisions to the Foreign Tax Act (Außensteuergesetz)

On 27 March 2024, new paragraphs (3d) and (3e) were added to the German Foreign Tax Act (Außensteuergesetz – AStG) regarding intragroup financing. Paragraph (3d) concerns the determination of arm’s length interest rates, group vs. stand-alone rating and whether capital is treated as a loan or equity. Paragraph (3e) concerns the treatment of financing arrangements, i.e. cash pools, hedging, etc ...

OECD releases the report on Amount B

On 19 February 2024, the OECD announced the release of the report on Amount B, which provides a simplified and streamlined approach to the application of the arm’s length principle to baseline marketing and distribution activities. The report, which introduces two options for implementation for jurisdictions that opt into the simplified and streamlined approach from January 2025, describes the circumstances under which a distributor is within scope of Amount B including cases where it also performs certain non-distribution activities, such as manufacturing. It also sets out the activities that may ...

FTA Article on Swiss Transfer Pricing Legislation and Practices as of 1 January 2024

The Swiss Federal Tax Authorities have published an Article on the status of transfer pricing legislation in Switzerland as of 1 January 2024. The Article describes the existing legal basis for the application of the arm’s length principle in Switzerland and reference is made to the OECD Transfer Pricing Guidelines as well as to Swiss administrative practice and case law. The article is available in French, German and English. The English version is provided below ...

Malta issues Transfer Pricing Guidance

On January 19, 2024, the Maltese Commissioner of Taxes and Customs published local guidelines in relation to the transfer pricing rules introduced in Malta in November 2022. The local guidelines refer to the OECD Transfer Pricing Guidelines 2022 in relation to the application of transfer pricing methods, comparability analysis, transfer pricing documentation, etc ...

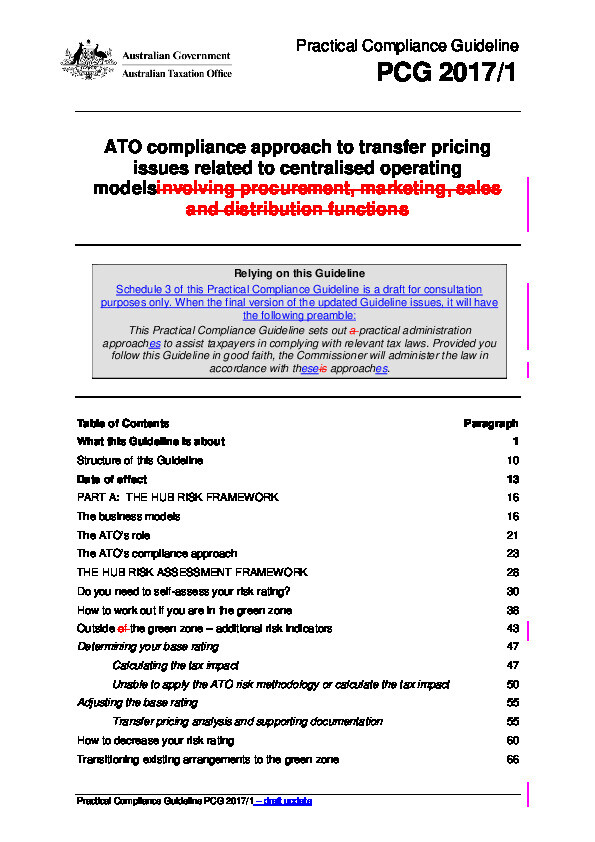

Australia finalises compliance guideline on intangibles migration arrangements – PCG 2024/1

17 January 2024 the Australian Taxation Office published the final version of its Practical Compliance Guideline PCG 2024/1 Intangibles migration arrangements. The PCG has previously been released in drafts as PCG 2021/D4 and PCG 2023/D2 Intangibles arrangements. The final version sets out ATO’s compliance approach to the tax risks associated with certain cross-border related party intangibles arrangements involving: restructures or changes to arrangements involving intangible assets (referred to as ‘migrations’ in the PCG) the mischaracterisation or non-recognition of Australian activities connected with intangible assets. Changes and additions included in the ...

Coca-Cola in $174 million tax dispute with the ATO

According to various articles in Australian media, Coca-Cola is now defending itself in a case pending before the Federal Court over unpaid withholding tax on royalties received from Coca-Cola Amatil Australia – a local bottler and distributor in which Coca-Cola has a minority shareholding. The case is very similar to that against PepsiCo, where the Federal Court, in a judgment dated 30 November 2023, found PepsiCo liable for additional taxes and penalties. According to the Australian Tax Office, Coca-Cola licensed intangibles (trademarks, branding etc.) to Coca-Cola Amatil Australia, but misclassified ...

United Arab Emirates issues comprehensive Transfer Pricing Guide

On 23 October 2023, the United Arab Emirates issued a comprehensive practical Transfer Pricing Guide. The guide is designed to provide general guidance on the Transfer Pricing regime in the UAE with a view to making the provisions of the Transfer Pricing regulations as understandable as possible to readers. UAE’s Transfer Pricing regulations are contained in Federal Decree-Law No. 47 of 2022 on the Taxation of Corporations and Businesses, Chapter 10 ...

IRS says Microsoft owes $28.9 billion in back taxes

11 October 2023 Microsoft announced that the IRS has claimed that it owes $28.9 billion in back taxes for the years 2004 to 2013, plus penalties and interest. The claim relates to cost-sharing arrangements used by Microsoft to allocate profits between countries during this period. According to Microsoft, its subsidiaries shared in the costs of developing certain intellectual property and, therefore, the subsidiaries were entitled to the related profits under the IRS cost-sharing regulations ...

Brazil publishes comprehensive normative instructions for its new transfer pricing rules

29 September 2023 Brazil published normative instructions (IN RFB nº 2.161/23) for its new transfer pricing rules, which will apply from FY 2024 onwards. Brazil’s transfer pricing legislation is now in line with the OECD Transfer Pricing Guidelines. In fact, the new legislation is the result of a joint project between the Brazilian Federal Revenue Service (Receita Federal do Brasil) and the OECD. The normative instructions deal with the general aspects of the new law, which form the basic part of the new system and apply to all transactions falling ...

EU Commission proposes to simplify tax rules – and harmonise transfer pricing rules across the EU

12 September 2023, the European Commission published a new proposal to simplify tax rules and harmonise transfer pricing rules across the EU. According to the press release, the proposal, called “Business in Europe: Framework for Income Taxation” (BEFIT), will make life easier for both businesses and tax authorities by introducing a new, single set of rules to determine the tax base of groups of companies. This will reduce compliance costs for large businesses who operate in more than one Member State and make it easier for national tax authorities to ...

138 countries agree historic milestone to implement OECD’s Two‐Pillar Solution

12 July 2023 138 members of the OECD/G20 Inclusive Framework agreed an Outcome Statement recognising the significant progress made and allowing countries and jurisdictions to move forward with historic, major reform of the international tax system. The Two‐Pillar Solution to Address the Tax Challenges Arising from the Digitalisation of the Economy will ensure a fairer distribution of profits and taxing rights among countries and jurisdictions with respect to the world’s largest Multinational Enterprises (MNEs). The Outcome Statement agreed at the 15th Meeting of the Inclusive Framework follows 20 months of ...

Brazil publishes new updated 2023 transfer pricing legislation – aligned with OECD guidelines

14 June 2023 Brazil issued it’s new updated transfer pricing legislation, which is now aligned with OECD transfer pricing guidelines. Click here for unofficial English translation ...

New German Administrative Principles on Transfer Pricing (BMF-AO-2023)

6 June 2023 Germany published it’s new updated administrative principles on transfer pricing. The new publication includes expanded guidance on transfers of functions (and valuation – see English translation) and financial transactions. With regard to the latter, reference is made to two recent decisions of the Federal Fiscal Court (BFH) on intra-group loans (BFH of 18 May 2021, I R 4/17, and of 13 January 2022, I R 15/21). With the exception of the new content on transfer of functions, the new principles can be applied retroactively by the tax ...

Malaysia issues new Transfer Pricing Rules for 2023

On 29 May 2002, Malaysia updated its existing TP rules. The new rules are largely in line with the OECD Transfer Pricing Guidelines, but there are minor differences. For example, the new rules state that the arm’s length range is defined as the range between the 37.5th and 62.5th percentiles of a data set. Furthermore, according to the new rules, the tax authorities may make adjustments to the median or any point above the median, even if a taxpayer’s price is already within the arm’s length range where there is ...

Poland issues Tax clarifications on transfer pricing – No. 5: Resale Price Method

24 March 2023 the Polish Ministry of Finance issued Tax clarifications on transfer pricing No. 5: Resale Price Method The resale price method (RPM) is one of the traditional transaction methods and probably most useful where it is applied to distribution operations.. Application of the RPM for determining the price of a controlled transaction begins with the price at which a product that has been purchased from an associated enterprise is resold to an independent enterprise. This price (the resale price) is then reduced by an appropriate gross margin on ...

Germany issues draft law for implementation of the global minimum tax – OECD Pillar II

The German Federal Ministry of Finance issues draft law for the implementation of the EU Directive to ensure a global minimum level of taxation for multinational groups of companies and large domestic groups in the Union The aim of the draft law is to implement key elements of the international agreements on Pillar 2 of the so-called two-pillar solution. The post-taxation provisions contained therein are intended to ensure a global effective minimum taxation, to counteract harmful tax competition and aggressive tax structuring and thus to contribute to the promotion of ...

AMPOL enters $157 million tax settlement with Australian Tax Office

20 February 2023 Ampol Limited announced entering a $157 million tax settlement agreement with the Australian Tax Office in a dispute over pricing of transactions between Ampol Limited and the group’s Singapore procurement hub. Ampol is an Australian based petroleum distributor and retailer, with more than 1,900 Ampol-branded gas stations across the country. Ampol Singapore was established in late 2013 and is the trading and shipping arm of the Group. According to an announcement issued by Ampol, the settlement relates to financial years ended 31 December 2014 to 2022, as ...

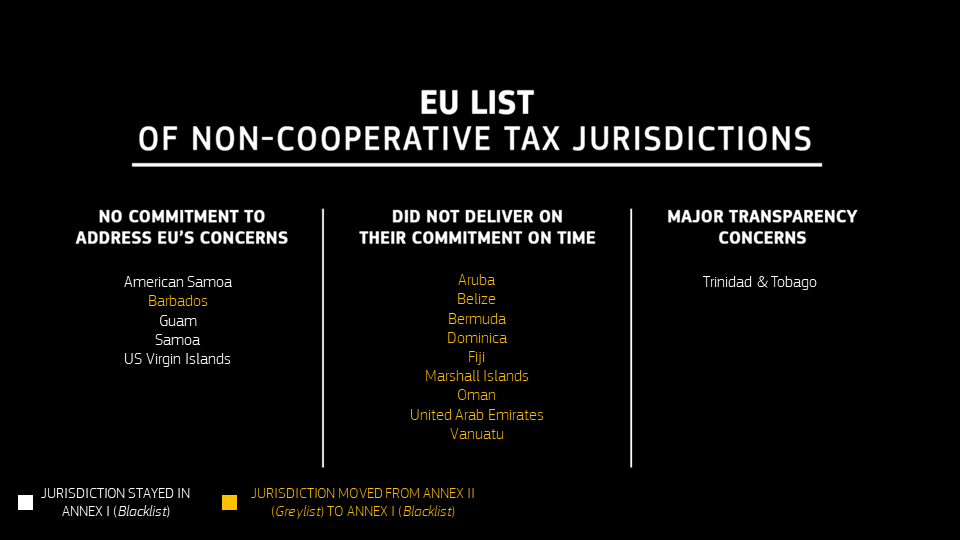

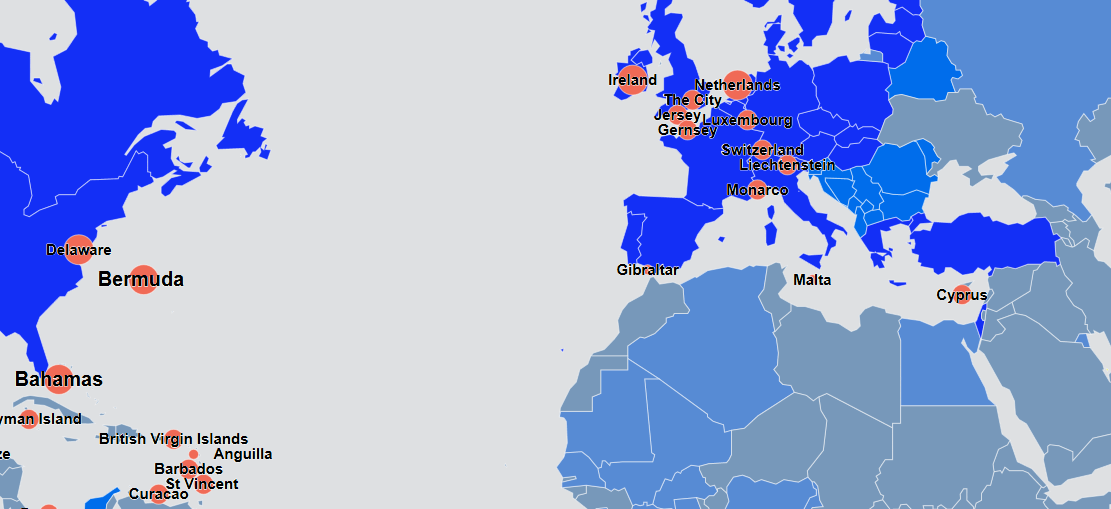

EU list of Non-Cooperative Tax Jurisdictions – Tax Havens

14 February 2023 the Council of the European Union published an updated list of non-cooperative tax jurisdictions. The British Virgin Islands, Costa Rica, the Marshall Islands and Russia have been added to the list, which now comprises 16 jurisdictions: American Samoa Anguilla Bahamas British Virgin Islands Costa Rica Fiji Guam Marshall Islands Palau Panama Russia Samoa Trinidad and Tobago Turks and Caicos Islands US Virgin Islands Vanuatu This revised EU list of non-cooperative tax jurisdictions includes countries that either have not engaged in a constructive dialogue with the EU on ...

Interpretation statement from the Inland Revenue of New Zealand on application of the general anti-avoidance provision

3 February 2023 the Inland Revenue of New Zealand issued an interpretation statement explaining the Commissioner’s view of the law on tax avoidance in New Zealand. It sets out the approach the Commissioner will take to the general anti-avoidance provisions in the Income Tax Act 2007 – ss BG 1 and s GA 1. Where s BG 1 applies, s GA 1 enables the Commissioner to make an adjustment to counteract a tax advantage obtained from or under a tax avoidance arrangement. The Supreme Court in Ben Nevis considered it ...

OECD publishes Guidance on the Handling of Multilateral MAPs and APAs

1 February 2023 OECD published guidance on Multilateral MAP and APAs. The Manual is intended as a guide to multilateral MAP and APA processes from both a legal and procedural perspective and provides tax administrations and taxpayers with information on the operation of these procedures and suggests different approaches based on the practices of jurisdictions, without imposing a set of binding rules. The Manual is divided into the following sections: Introduction: This section comprises the outline of the project, the challenges that generally arise in multilateral cases and the overview ...

The South African Revenue Service (SARS) issues Arm’s Length Guidance on Intra-Group Loans

17 January 2023 the South African Revenue Service (SARS) released an interpretation note (IN 127) titled “DETERMINATION OF THE TAXABLE INCOME OF CERTAIN PERSONS FROM INTERNATIONAL TRANSACTIONS: INTRA-GROUP LOANS” which provides guidance on how SARS will determine arm’s length pricing for intra-group loans. The Note also provides guidance on the consequences for a taxpayer if the amount of debt, the cost of debt or both are not arm’s length. According to the note an intra-group loan would be incorrectly priced if the amount of debt funding, the cost of the ...

Brazil issues Draft Legislation on implementation of the Arm’s Length Principle

28 December 2022 Brazil published draft legislation on implementation of the arm’s length principle as described in the OECD Transfer Pricing Guidelines. The new provisions came into effect on the date of publication and must be converted into law by the National Congress. The new transfer pricing regime will be optional for taxpayers for 2023 and mandatory as of 2024. Unofficial English Translation ...

US Supreme Court denies Whirlpool’s request for judicial review of the 2021 judgment from the Court of Appeal.

21 November 2022 the US Supreme Court denied Whirlpool its request for judicial review of the December 2021 judgment of the Court of Appeal (Sixth Circuit). 10 August 2022 Whirlpool filed a “petition for writ” with the Supreme Court of the United States. “Petitioners Whirlpool Financial Corporation & Consolidated Subsidiaries and Whirlpool International Holdings S.à.r.l. & Consolidated Subsidiaries collectively, “Whirlpool”) respectfully petition this Court for a writ of certiorari to review the judgment of the United States Court of Appeals for the Sixth Circuit in this case.” The case revolves ...

TELE2 announces SEK 1,8 billion victory in Swedish Courts

In a press release dated November 7, 2022, TELE2 announced a SEK 1,8 billion win related to tax deductions for foreign exchange losses on intra-group loans, that had previously been disallowed by the Swedish tax authorities in an assessment issued back in 2019. According to the tax authorities the company would not – at arms length – have agreed to a currency conversion of certain intra-group loans which resulted in the loss. Tele2 appealed the decision to the Administrative Court where, during the proceedings, the authorities acknowledged deductions in part ...

Caterpillar announces $740 million settlement with the IRS

In a press release dated October 27, 2022, Caterpillar announced that a $740 million settlement had been reached with the IRS related to tax issues for FY 2007 through 2016. In the third quarter of 2022, the company reached a settlement with the U.S. Internal Revenue Service (IRS) that resolves all issues for tax years 2007 through 2016, without any penalties. The company’s settlement includes, among other issues, the resolution of disputed tax treatment of profits earned by Caterpillar SARL (CSARL) from certain parts transactions. The company vigorously contested the ...

Credit Suisse enters EUR 238 million settlement agreement in France

A settlement agreement between the French Financial Public Prosecutor and Credit Suisse was announced in the Paris Court of Appeal 24 October 2022. The “CJIP” agreement brings an end to investigations in France over whether the Swiss bank facilitated and aided clients in tax avoidance. (English translation of the press release from the French Public Prosecutor) On 24 October 2022, the President of the Paris Judicial Court validated the judicial public interest agreement (CJIP) concluded on 21 October 2022 between the Financial Public Prosecutor (PRF) and CREDIT SUISSE AG pursuant ...

OECD Publishes Updated Guidance on CbC Reporting

On 14 October 2022 OECD published updated guidance on CbC reporting. The guidance contains definitions of items in the CbC reporting template – revenue, related parties, tax accrued and paid, fair value accounting, positive and negative figures etc. Issued related to particular reporting entities is also addressed (investment funds, major shareholding, deemed listing provisions and permanent establishment information. Guidance is provided on common issues such as currency fluctuations, definition of consolidated revenue, long and short accounting periods, mergers – demergers and acquisitions, and errors made by MNE groups in preparing ...

OECD Publishes Manual on Bilateral Advance Pricing Arrangement

On 28 September 2022 OECD published a new manual for entering bilateral advance pricing arrangement (APA’s) which has been approved by the Inclusive Framework on BEPS, as well as all members of the FTA, on 6 July 2022. The Bilateral Advance Pricing Arrangement Manual (“BAPAM” or “Manual”) is intended as a guide to tax administrations and taxpayers for streamlining the bilateral APA process. In addition to detailing several Best Practices for engaging in bilateral APAs, it also includes practical resources for tax administrations and taxpayers, such as templates and examples. It ...

Banca Generali announces EUR 45 Million Settlement with Italian Revenue Agency

Italian financial institute, Banca Generali, has signed a agreement with the Italian Revenue Agency, whereby the parties agreed upon the terms and conditions for the settlement of tax claims in relation to transfer pricing for FY 2014 to 2018. Under the agreement, Banca Generali will incur an additional tax charge of €45.99 million for FY 2014-2018. The tax dispute relates to remuneration for a transfer in 2008 of fund management activities in Italian to a newly established Luxembourg company, BG Fund Management Luxembourg S.A. According to the announcement, no penalties ...

Uber-files – Tax Avoidance promoted by the Netherlands

Uber files – confidential documents, leaked to The Guardian newspaper shows that Uber in 2015 sought to deflect attention from its Dutch conduits and Caribbean tax shelters by helping tax authorities collect taxes from its drivers. At that time, Uber’s Dutch subsidiary received payments from customers hiring cars in cities around the world (except US and China), and after paying the drivers, profits were routed on as royalty fees to Bermuda, thus avoiding corporate income tax. In 2019, Uber took the first steps to close its Caribbean tax shelters. To ...

Australian Treasury issues Consultation Paper on Multinational Tax Integrity and Tax Transparency

As part of a multinational tax integrity package aimed to address the tax avoidance practices of multinational enterprises (MNEs) and improve transparency through better public reporting of MNEs’ tax information, the Australian Treasury issued a Consultation Paper in August 2022. This paper seeks to consult on the implementation of proposals to: amend Australia’s existing thin capitalisation rules to limit interest deductions for MNEs in line with the Organisation for Economic Cooperation and Development (OECD)’s recommended approach under Action 4 of the Base Erosion and Profit Shifting (BEPS) program (Part 1); ...

2022: ATO Taxpayer Alert on Treaty shopping arrangements to obtain reduced withholding tax rates (TA 2022/2)

The ATO is currently reviewing treaty shopping arrangements designed to obtain the benefit of a reduced withholding tax (WHT) rate under a double-tax agreement (DTA) in relation to royalty or dividend payments from Australia. Typically, this benefit is sought via the interposition of one or more related entities between an Australian resident and the ultimate recipient of the royalty or dividend, where the interposed entity is a resident of a treaty partner jurisdiction. The ultimate recipient is generally located in a jurisdiction that either does not have a DTA with Australia ...

Rio Tinto has agreed to pay AUS$ 1 billion to settle a dispute with Australian Taxation Office over its Singapore Marketing Hub

On 20 July 2022 Australian mining group Rio Tinto issued a press release announcing that a A$ 1 billion settlement had been reached with the Australian Taxation Office. “The agreement resolves the disagreement relating to interest on an isolated borrowing used to pay an intragroup dividend in 2015. It also separately resolves the pricing of certain transactions between Rio Tinto entities based in Australia and the Group’s commercial centre in Singapore from 2010-2021 and provides certainty for a further five-year period. Rio Tinto has also reached agreement with the Inland ...

German draft-legislation on application of the arm’s length principle to cross-border relocation of functions

On 5 July 2022, the Federal Ministry of Finance in Germany published draft legislation regarding application of the arm’s length principle to cross-border relocation of functions. According to the general provisions A function is a business activity that consists of a grouping of similar operational tasks performed by specific units or departments of an enterprise. It is an organic part of an enterprise, without the need for a sub-operation in the tax sense. A transfer of functions within the meaning of section 1(3b) of the Foreign Tax Act occurs if ...

The Netherlands releases New 2022 Decree on Profit Allocation to PE’s

July 1 2022 the State Secretary of Finance has issued updated guidance on the profit allocation to permanent establishments – Decree no. 16683. The purpose of the guidance is to clarify the way in which the Tax and Customs Administration assesses the profit allocation to permanent establishments. Attention is paid to the introduction of the object exemption in the Corporate Income Tax Act 1969 (Corporate Tax Act 1969) in 2012, a number of editorial changes have been made and references to other decrees and documents have been updated. Click here ...

The Netherlands releases New 2022 Decree on application of the Arm’s Length Principle

On 1 July 2022, the tax authorities in the Netherlands published Decree No. 2022-0000139020 of 14 June 2022 containing local guidance on application of the arm’s length principle. The Decree is based on article 9 of the OECD Model Tax Convention and the OECD Transfer Pricing Guidelines and also contains references to local case laws. In the Decree, particular focus is on areas that have been updated in the most recent releases of the OECD Transfer Pricing Guidelines – Legal ownership, DEMPE functions, Services, HTVI and Valuation Methods, Government policies ...

McDonald’s has agreed to pay €1.25bn to settle a dispute with French tax authorities over excessive royalty payments to Luxembourg

On 16 June 2022 McDonald’s France entered into an settlement agreement according to which it will pay €1.245 billion in back taxes and fines to the French tax authorities. The settlement agreement resulted from investigations carried out by the French tax authorities in regards to abnormally high royalties transferred from McDonald’s France to McDonald’s Luxembourg following an intra group restructuring in 2009. McDonald’s France doubled its royalty payments from 5% to 10% of restaurant turnover, and instead of paying these royalties to McDonald’s HQ in the United States, going forward ...

AFIP has published a non exhaustive list of Low and No Tax Jurisdictions (LNTJ)

The Federal Tax Administration of Argentine (AFIP) has published a non exhaustive list of 41 Low and No Tax Jurisdictions (LNTJ). The list related to Law 27,430 from 29 December 2017 which introduced certain adverse tax implications for transactions with LNTJs. For instance, according to the Law transactions with unrelated parties in LNTJs are not deemed arm’s length for transfer pricing purposes. Furthermore such transactions are required to be reported to the tax authorities. LNTJs refers to jurisdictions where the income tax rate is 60% lower than the minimum 25 ...

Italy releases operational instructions on arm’s length range and benchmarking.

On 24 May 2022, the Italian Tax Agency (Agenzia delle Entrate) released CIRCULAR NO. 16/E containing operational instructions on issues relating to application of the arm’s length range. The circular – which is based on the OECD transfer Pricing Guidelines, guidance on benchmark studies issued by the Joint Transfer Pricing Forum, and relevant Italian case laws – provides operational instructions regarding the correct interpretation of the notion of “arm’s length range”, as also specified in Article 6 of the Decree of 14 May 2018, when applying the provisions set forth ...

Amgen in Billion Dollar Transfer Pricing Dispute with the IRS

Amgen, in its quarterly report for the period ended March 31, 2022, disclosed that, not only has the group been issued a notice of assessments from the IRS for FY 2010-2012 resulting in additional taxes of approximately $3.6 billion plus interest – as previously reported – it has also received a Revenue Agent Reports (RAR) for 2013-2015 resulting in additional taxes of approximately $5.1 billion, plus interest and penalties of approximately $2.0 billion. Furthermore, it is disclosed that Amgen is currently under examination by the IRS for the years 2016, ...

Tokyo High Court rules in favour of NGK Insulators

In a decision issued on March 10, 2022 the Tokyo High Court upheld a 2020 decision from the district court and ruled mostly in favour of NGK INSULTATORS, LTD. in an appeal filed against a transfer pricing correction issued in 2012 by the Japanese tax authorities. The case At issue was whether the royalties received by NGK Insulators, the HQ of a Japanese group, from its Polish subsidiary, were lower than the arm’s length price. Due to the tightening of European emission regulations, only two companies at the European market, ...

Exor in €746 million settlement with the Italian Tax Authorities

In a press release dated February 18, 2022, Exor announced that a €746 million settlement had been reached with the Italian Tax Authorities (“Agenzia delle Entrate”) related to a cross-border merger in December 2016 that resulted in all the activities of the group being moved from Italy to the Netherlands. According to Exor the exit tax claimed by the tax authorities was a result of a changed interpretation of Italien Participation Exemption rules issued by the authorities: Principio di diritto n. 10/2021 ...

South African Revenue Service releases comprehensive Interpretation Note on intra-group loans

The South African Revenue Service (SARS) has published a comprehensive Interpretation Note on intra-group loans. The note provides taxpayers with guidance on the application of the arm’s length principle in the context of the pricing of intra-group loans. The pricing of intra-group loans includes a consideration of both the amount of debt and the cost of the debt. An intra-group loan would be incorrectly priced if the amount of debt funding, the cost of the debt or both are excessive compared to what is arm’s length. The Note also provides ...

OECD releases new 2022 edition of the OECD Transfer Pricing Guidelines

On 20 January 2022 the OECD released the 2022 edition of the OECD Transfer Pricing Guidelines for Multinational Enterprises and Tax Administrations. The OECD Transfer Pricing Guidelines provide guidance on the application of the “arm’s length principle”, which represents the international consensus on the valuation, for income tax purposes, of cross-border transactions between associated enterprises. In today’s economy where multinational enterprises play an increasingly prominent role, transfer pricing continues to be high on the agenda of tax administrations and taxpayers alike. Governments need to ensure that the taxable profits of ...

Finnish TP-Legislation updated to include non-recognition and recharacterisation

Effective as of 1. January 2022 Finnish Transfer Pricing legislation has been updated to align the rules with the OECD Transfer Pricing Guidelines in regards to non-recognition and recharacterisation. Going forward the arm’s length provision in the Tax Procedure Act, section 31, will include the possibility for non-recognition and recharacterisation which according to Finnish Case Law has not been possible under the previous wording of the provision. Case NameDescriptionDateCountryKeywords ...

Swiss UBS bank to pay € 1,8 billion fine for “facilitation of tax evasion and money laundering”

The appeal court in Paris has confirmed that the Swiss UBS banking group is guilty of having facilitated tax evasion and money laundering in France, and on that basis the banking group was issued a €5,625 million fine plus confiscation of €1 billion and damages in the sum of €800 millions. Read the December 2021 judgment here ...

EU directive on minimum effective tax rate – implementation of OECD Pillar II

The European Commission has proposed a Directive ensuring a minimum effective tax rate for the global activities of large multinational groups. The proposal delivers on the EU’s pledge to move extremely swiftly and be among the first to implement the recent historic global tax reform agreement, which aims to bring fairness, transparency and stability to the international corporate tax framework. The proposed directive follows closely the international agreement and sets out how the principles of the 15% effective tax rate – agreed by 137 countries – will be applied in ...

OECD releases Pillar Two model rules – Global Minimum Tax of 15%

The OECD has published detailed rules to assist in the implementation of a landmark reform to the international tax system, which will ensure Multinational Enterprises (MNEs) will be subject to a minimum 15% tax rate from 2023. The Pillar Two model rules provide governments a precise template for taking forward the two-pillar solution to address the tax challenges arising from digitalisation and globalisation of the economy agreed in October 2021 by 137 countries and jurisdictions under the OECD/G20 Inclusive Framework on BEPS. The rules define the scope and set out ...

Poland issues tax clarifications on transfer pricing – No. 4: Transactional Net Margin Method (TNMM)

1 December 2021 the Polish Ministry of Finance issued Tax clarifications on transfer pricing No. 4: Transactional Net Margin Method (TNMM) Clarification on application of the TNMM is provided in these areas: A. Principles of TNMM use A.1. Scope of application of the method A.2. Tested party A.3. Determination of net profit margin A.4. Definition of the base A.5. Choice of profitability indicator A.6. Profitability comparison B. Criteria for comparability of transactions and entities C. Difficulties in applying TNMM D. Comparison with other methods E. Practical application of TNMM Click ...

ResMed Inc has entered a $381.7 million tax settlement agreement with the Australian Tax Office

ResMed – a world-leading digital health company – in an October 2021 publication of results for the first quarter of FY 2022, informs that a $381.7 million tax settlement agreement has been entered with the Australian Tax Office. The dispute concerns the years 2009 through 2018, in which the ATO alleged that ResMed should have paid additional Australian taxes on income derived from the company’s Singapore operations. Excerpts from the announcement “Operating cash flow for the quarter was negative $65.7 million and was impacted by a payment to the Australian ...

Pandora Papers – a new leak of financial records

A new huge leak of financial records revealed by ICIJ, once again shows widespread use of offshore accounts, shell companies and trusts to hide wealth and/or avoid taxes. The new leak is known as the Pandora Papers and follows other recent leaks – lux leak, panama papers, paradise papers. The International Consortium of Investigative Journalists obtained 11.9 million confidential documents from 14 separate legal and financial services firms, which the group said offered “a sweeping look at an industry that helps the world’s ultrawealthy, powerful government officials and other elites ...

OECD deal on taxation of MNEs – Global Minimum Tax of 15%

Major reform of the international tax system finalised today at the OECD will ensure that Multinational Enterprises (MNEs) will be subject to a minimum 15% tax rate from 2023. The landmark deal, agreed by 136 countries and jurisdictions representing more than 90% of global GDP, will also reallocate more than USD 125 billion of profits from around 100 of the world’s largest and most profitable MNEs to countries worldwide, ensuring that these firms pay a fair share of tax wherever they operate and generate profits. Following years of intensive negotiations ...

ATO and Singtel in Court over Intra-company Financing Arrangement

In 2001, Singtel, through its wholly owned Australian subsidiary, Singapore Telecom Australia Investments Pty Limited (Singtel Au), acquired the majority of the shares in Cable & Wireless Optus for $17.2 billion. The tax consequences of this acqusition was decided by the Federal Court in Cable & Wireless Australia & Pacific Holding BV (in liquiatie) v Commissioner of Taxation [2017] FCAFC 71. Cable & Wireless argued that part of the price paid under a share buy-back was not dividends and that withholding tax should therefor be refunded. The ATO and the ...

Perrigo has settled its €1.6 billion tax bill with the Irish Revenue for €297 million

Pharmaceutical group Perrigo has settled a €1.6 billion case with the Irish Revenue Commissioners for €297 million. Perrigo was issued a tax assessment in 2018. The assessment related to Perrigo’s tax treatment of income generated by the sale of the rights to Tysabri – a drug for the treatement of multiple sclerosis. The tax authorities held that proceeds form the sale of these rights – more than $ billion – was a capital transaction taxed at a rate of 33%, while Perrigo had treated the proceeds as trading income taxed ...

German TP-Legislation updated as of June 2021

German legislation on transfer pricing has been updated to align the rules with the OECD Transfer Pricing Guidelines 2017. The new amendments are effective as of fiscal year 2022. The update includes revised content on Substance over form Risk analysis Best method rule Use of interquartile range Aggregation of transactions Determination of actual ownership vs legal ownership DEMPE functions Valuation of Hard to value intangibles Click here for unofficial English translation ...

OECD releases statement on support of the two pillar tax plan – joined by 130 countries

A OECD statement has been issued where 130 countries and jurisdictions have agreed to join and support the two pillar plan. A small group of 9 countries have not yet joined the Statement. “The two-pillar package aims to ensure that large Multinational Enterprises (MNEs) pay tax where they operate and earn profits, while adding much-needed certainty and stability to the international tax system. Pillar One will ensure a fairer distribution of profits and taxing rights among countries with respect to the largest MNEs, including digital companies. It would re-allocate some ...

G7 Support for OECD’s proposal on a Global Tax Reform – Pillar I and II

The G7 has agreed to back an international agreement on global tax reforms aimed at ending the reign of tax havens and have big international companies start paying their fair share of taxes. Under Pillar One of the reform, multinationals will be required to pay tax in the countries where they sell there products – and not just where they have their headquarters. The rules would apply to largest global firms with at least a 10% profit margin – and would see 20% of profit above the 10% margin reallocated ...

2021: ATO Draft Practical Compliance Guidelines on Intangibles Arrangements, PCG 2021/D4

The Australian Taxation Office (ATO) has issued draft Compliance Guidelines on intangible arrangements, PCG 2021/D4. These Guidelines will (when finalised) set out the ATO’s compliance approach to international arrangements connected with the development, enhancement, maintenance, protection and exploitation of intangible assets, specifically, the potential application of the transfer pricing, general anti-avoidance rule (GAAR) and the diverted profits tax (DPT) provisions. The capital gains tax and capital allowances provisions will also be discussed in this Guideline where these may be considered alongside, or relevant to, the ATO’s transfer pricing, GAAR or ...

Paraguay’s TP Decree in effect as of April 2021

Paraguay’s new Transfer Pricing Decree in effect as of April 2021. Click here for English Translation ...

US Senate Committee request records related to tax schemes involving Caterpillar and Renaissance Technologies

In a letter dated 28. April 2021 the US Senate Committee on Finance has request records related to tax schemes involving Caterpillar and Renaissance Technologies. “In 2015, Caterpillar disclosed that a federal grand jury in Illinois had begun investigating an alleged tax scheme involving the company’s Swiss subsidiary. This investigation led to raids by federal agents on three different Caterpillar offices in March 2017. 4 Days after the raids, Caterpillar announced it retained Mr. Barr “to take a fresh look at Caterpillar’s disputes with the government, get all the facts, ...

UN releases New 2021 Practical Manual on Transfer Pricing

On 27 February 2021 UN released a new 2021 Practical Manual on Transfer Pricing. “…this third edition of the Manual makes improvements in usability and practical relevance, updates and improves the existing text, including on Country Practices (Part D) and has new content, in particular, on financial transactions, profit splits, centralized procurement functions and comparability issues. Improved capacity development based on the Manual has encouraged and contextualized developing country feedback, helped identify these priority areas for improvement and contributed to better targeting the messages in the Manual and examples used.” ...

Bristol-Myers Squibb in Dispute with IRS over “Abusive Offshore Scheme”

According to the IRS, Bristol-Myers Squibb reduces its U.S. taxes by holding valuable intangibles in an Irish subsidiary. In a legal analysis, the IRS concluded that the Irish scheme saves Bristol-Myers Squibb up to $1.38 billion in US taxes. From Bristol-Myers Squibb’s 2019 10-K form, “Note 7. Income Taxes” “BMS is currently under examination by a number of tax authorities which have proposed or are considering proposing material adjustments to tax positions for issues such as transfer pricing, certain tax credits and the deductibility of certain expenses. It is reasonably ...

Poland issues Tax clarifications on transfer pricing – No. 2: Transfer Pricing Adjustments

31 March 2021 the Polish Ministry of Finance issued tax clarifications on transfer pricing – No. 2: Transfer Pricing Adjustments Click here for unofficial English translation ...

Poland issues Tax clarifications on transfer pricing – No. 3: CUP method

31 March 2021 the Polish Ministry of Finance published tax explanations on transfer pricing No. 3 regarding the CUP method The explanations covers: the rationale for using the comparable uncontrolled price method, variants of the comparable uncontrolled price method, comparison of the comparable uncontrolled price method with other methods, typical areas of application of the comparable uncontrolled price method, difficulties in applying the comparable uncontrolled price method, example of using the comparable uncontrolled price method. Click here for unofficial English translation ...

Spain releases note on arm’s length range and benchmarking

On 25 February 2021, a note was released by the Spanish Tax Agency on number of practical issues relating to application of the arm’s-length range. The note – which is based on the OECD transfer Pricing Guidelines, guidance on benchmark studies issued by the Joint Transfer Pricing Forum, and relevant Spanish case laws – answers the following questions: – How is the range of values determined? – Is it possible to determine a range of values in which the figures are relatively equally reliable? – How to proceed if a ...

French Guidance on Intra Group Loans

French guidance on application of the arm’s length principle to intra-group loans and interest deductions. Click here for unofficial English translation ...

Airbnb under examination by the Internal Revenue Service for 2013 and 2016

Airbnb is under examination by the Internal Revenue Service for its income taxes in 2013 and 2016, according to the company’s December 2020 SEC filing. According to the filing a draft notice of adjustment from the IRS proposes that the company owes an additional $1.35 billion in taxes plus interest and penalties for the years in question. The assessment is related to valuation of its intellectual property that was transferred to a subsidiary in FY 2013. Airbnb then had had two subsidiaries outside the United States – Airbnb International Holdings Ltd ...

Mining Company Oyu Tolgoi LLC receives a second Tax Assessment from the Mongolian Tax Authority

The Oyu Tolgoi copper-gold mine is a joint venture between Turquoise Hill Resources (which is 50.8 per cent owned by Rio Tinto), and the Mongolian Government. The Mongolian government has not been satisfied by the result of the joint venture and has concerns that increasing development costs of the Oyu Tolgoi project has eroded the economic benefits it anticipated receiving. “It is calculated that Mongolia will not receive dividend payments until 2051 and will incur debts of US$22 billion,” said Mongolia’s deputy chief cabinet secretary, Solongoo Bayarsaikhan. “In addition, Oyu ...

Diageo – British multinational beverage and alcohol group – is facing various tax challenges

Diageo (British multinational beverage and alcohol group – owner of numerus brands including Jonny Walker, Captain Morgan, Gordons Gin, Smirnoff and Guinness) is facing difficult tax challenges according to the group’s August 2020 SEC-filings. During 2017 Diageo was in discussions with UK tax authorities to seek clarity on Diageo’s transfer pricing and related issues, and in the first half of the year ending 30 June 2018 a preliminary assessment for diverted profits tax notice was issued. Final charging notices were issued in August 2017 and Diageo paid £107 million in ...

OECD Guidance on the transfer pricing implications of the COVID-19 pandemic

Unique economic conditions arising from COVID-19 and government responses to the pandemic have led to practical challenges for the application of the arm’s length principle. For taxpayers applying transfer pricing rules for the financial years impacted by the COVID-19 pandemic and for tax administrations that will be evaluating this application, there is an urgent need to address these practical questions. The OECD Transfer Pricing Guidelines for Multinational Enterprises and Tax Administrations 2017 (“OECD TPG”) are intended to help tax administrations and multinational enterprises (“MNEs”) find mutually satisfactory solutions to transfer ...

OECD Guidance on the transfer pricing implications of the COVID-19 pandemic

Unique economic conditions arising from COVID-19 and government responses to the pandemic have led to practical challenges for the application of the arm’s length principle. For taxpayers applying transfer pricing rules for the financial years impacted by the COVID-19 pandemic and for tax administrations that will be evaluating this application, there is an urgent need to address these practical questions. The OECD Transfer Pricing Guidelines for Multinational Enterprises and Tax Administrations 2017 (“OECD TPG”) are intended to help tax administrations and multinational enterprises (“MNEs”) find mutually satisfactory solutions to transfer ...

Peru – report on use of the most appropriate method to determine the market value of services

In december 2020 the tax authorities in Peru issued a new administrative ordinance related to use of the most appropriate method to determine the market value of services. Click here for English translation ...

New German Administrative Ordinance on transfer pricing issues AO 2020, DOK 2020/1174240

In december 2020 the Federal Ministry of Finance in German issued a new administrative ordinance related to various transfer pricing issues. Among the issues are enhanced requirement to cooperate and submit additional documentation related to controlled transactions, but most notable may be the conditions under which estimated tax assessments can be issued. Below is an unofficial translation of the document. Click here for the original document ...

Ørsted in billion dollar transfer pricing dispute with the Danish tax authorities

Ørsted is a Danish energy group that develops, constructs, and operates offshore and onshore wind farms, solar farms, energy storage facilities, renewable hydrogen and green fuels facilities, and bioenergy plants. According to a company announcement issued in December 2020, Ørsted has received an administrative decision from the Danish Tax Agency requiring Danish taxation of the company’s British offshore wind farms Walney Extension and Hornsea 1 in the tax years 2015 and 2016. The Danish Tax Agency’s claim amounts to DKK 5.1 billion, plus interest amounting to DKK 1.5 billion. According ...

AXA S.A. issued an income assessment of EUR 130 million by the French tax authorities

Insurance group AXA S.A. is now paying back millions of euros in taxes after French tax authorities found that a Luxembourg-based structure had been used by the group for tax avoidance. According to the French tax authorities AXE S.A. had undeclared taxable profits of at least 130 million in FY 2005 and 2010. The scheme involved use of a group entity in Luxembourg granting loans to AXA’s foreign subsidiaries. The entity in Luxembourg benefited from a tax ruling issued by Luxembourg’s authorities that allowed it to be tax-exempt. According ...

/ Hearings and Investigations, International Developments, Tax Havens and Harmful Tax Practices, Transfer Pricing News

Allegations of tax avoidance in Dutch Pharma Group Qiagen

According to investigations by SOMO – an independent center for Research on Multinational Corporations – the annual accounts of Pharma Group Qiagen shows that the group has avoided tax on profits by passing internal loans through an elaborate network of letterbox companies in European tax havens including Ireland, Luxembourg and Malta. It is estimated that, since 2010, the group has avoided at least €93 million in taxes and has accumulated tax deduction in an amount of €49 million ...

European Commission vs. Ireland and Apple, September 2020, Appeal of the Judgment of the General Court on the Apple tax State aid case in Ireland

The European Commission has decided to appeal the decision of the EU General Court in the State Aid case of Apple and Ireland. According to the European Commission Ireland gave illegal tax benefits to Apple worth up to €13 billion, because it allowed Apple to pay substantially less tax than other businesses. In a decision issued july 2020 the General Court held in favor of Apple and Ireland. This decision will now be reviewed by the European Court of Justice. “Statement by Executive Vice-President Margrethe Vestager on the Commission’s decision ...

September 2020: IRS Guide to the Transfer Pricing Examination Process

September 8, 2020 the IRS released a new guide to Transfer Pricing Examination Process. The Transfer Pricing Examination Process (TPEP) provides a guide to best practices and processes to assist with the planning, execution, and resolution of transfer pricing examinations consistent with the Large Business & International (LB&I) Examination Process (LEP), Publication 5125. This guide will be shared with taxpayers at the start of a transfer pricing examination, so they understand the process and can work effectively with the examination team. Transfer pricing examinations are factually intensive and require a ...

Facebook France has agreed to pay 106 million euros in back taxes and penalties

The agreement, according to which Facebook France will pay 106 million euros in back taxes and penalties, was reached after French tax authorities had carried out an extensive audit covering FY 2009-2018. Furthermore, Facebook’s French revenues were increased last year after the company decided to include advertising income from French companies in its local accounts, instead of declaring them in Ireland, where Facebook’s international operations are based. As a result, Facebook will pay 8.4 million euros in taxes in France this year – 50% more than last year. These changes ...

Korean tax authorities investigates Starbucks’ pricing of coffee beans

Starbucks Korea is now being investigated for overpricing goods and services imported from abroad. Officials from the National Tax Service have seized accounting records and data held at Starbucks’ Korean head office in Seoul. Subject of the investigation is transfer pricing of coffee beans and others products for sale at its more than 1,370 local shops. In 2019 Starbucks Korea reported sales of over 1.87 trillion won ($1.53 billion) and net profits of 132.8 billion won ...

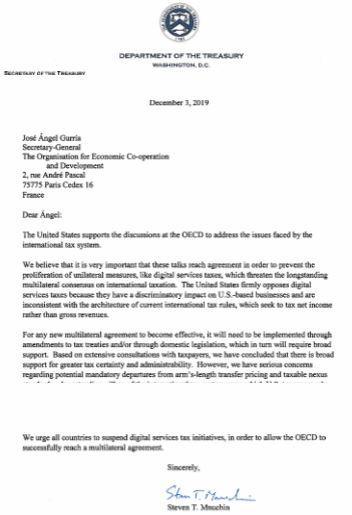

US Investigations into Digital Service Taxes

Washington, DC – The United States Trade Representative announced today that his office is beginning investigations into digital services taxes that have been adopted or are being considered by a number of our trading partners. The investigations will be conducted under Section 301 of the 1974 Trade Act. This provision gives the USTR broad authority to investigate and respond to a foreign country’s action which may be unfair or discriminatory and negatively affect U.S. Commerce. “President Trump is concerned that many of our trading partners are adopting tax schemes designed ...

Mining Group Rio Tinto in new $86 million Dispute with ATO over pricing of Aluminium

In March 2020 the Australian Taxation Office issued an tax assessment regarding transfer pricing to Rio Tinto’s aluminium division according to which additional taxes in an amount of $86.1 million must be paid for fiscal years 2010 – 2016. According to the assessment Rio’s Australian subsidiaries did not charge an arm’s length price for the aluminium they sold to Rio’s Singapore marketing hub. This new aluminum case is separate to Rio’s long-running $447 million dispute with the ATO over the transfer pricing of Australian iron ore. Rio intents to object ...

Fiat Chrysler reaches a EUR 2.5 billion settlement with the Italien tax authorities

Fiat Chrysler has reached a settlement with the Italian tax agency over taxable gains related to a transfer of the U.S. Chrysler business from Fiat SpA Italy to Fiat Chrysler Automobiles NV (Netherlands). The Italian tax agency claimed that the value of the U.S. Chrysler business had been underestimated and issued a preliminary assessment with an additional taxable gain of 5.1 billion euros. The agency had valued Chrysler at 12.5 billion euros, while Fiat SpA had declared it to be worth less than 7.5 billion. Under the terms of the ...

Altera asking the US Supreme Court for a judicial review of the 2019 Decision from the U.S. Court of Appeals concerning the validity of IRS regs. on CCAs

Altera has asked the US Supreme Court for a judicial review of the Decision from the U.S. Court of Appeals for the Ninth Circuit over the validity of Internal Revenue Service regulations that requires related companies to share the cost of stock-based employee compensation when shifting their intangible assets abroad applying US Cost Sharing regulations. In the decision a divided panel in the Court of Appeal upheld the regulation as “permissible” and therefore entitled to deference under Chevron, U.S.A., Inc. v. Natural Resources Defense Council, Inc., 467 U.S. 837 (1984) ...

2020: ATO Alert on arrangements and schemes connected with DEMPE of intangibles

The ATO is currently reviewing international arrangements that mischaracterise Australian activities connected with the development, enhancement, maintenance, protection and exploitation (DEMPE) of intangible assets. Such arrangements may be non-arm’s length or structured to avoid tax obligations, resulting in inappropriate outcomes for Australian tax purposes. One of the issues is whether functions performed, assets used and risks assumed by Australian entities in connection with the DEMPE of intangible assets are properly recognised and remunerated in accordance with the arm’s length requirements of the transfer pricing provisions in the taxation law. These ...

New TPG Chapter X on Financial Transactions (and additions to TPG Chapter I) released by OECD

Today, the OECD has released the report Transfer Pricing Guidance on Financial Transactions. The guidance in the report describes the transfer pricing aspects of financial transactions and includes a number of examples to illustrate the principles discussed in the report. Section B provides guidance on the application of the principles contained in Section D.1 of Chapter I of the OECD Transfer Pricing Guidelines to financial transactions. In particular, Section B.1 of this report elaborates on how the accurate delineation analysis under Chapter I applies to the capital structure of an ...

Google – Taxes and Transfer Pricing

Google’s tax affairs are back in the spotlight after filings in the Netherlands have showed that billions of dollars were moved to Bermuda in 2016 using the “double Irish Dutch sandwich”. According to the Washington Post, Google’s cash transfers to Bermuda reached $27b in 2016. Google uses the double Irish Dutch sandwich structure to shield the majority of it’s international profits from taxation. The setup involves shifting revenue from one Irish subsidiary to a Dutch company with no employees, and then on to a Bermuda-mailbox owned by another company registered ...

Malaysian Energy Group – TENAGA Nasional Bhd – has been issued a RM 4.000.000.000 tax bill by the Revenue Board of Malaysia

Malaysian Energy Group – TENAGA Nasional Bhd – has begun legal proceedings against the Inland Revenue Board of Malaysia. In November 2019, the Inland Revenue Board issued a tax assessment according to which taxes of RM3.98 bil (or USD 1 billion) is owed for years 2015-2017. After reciving the assessment, TENAGA responded “Based on the legal advice obtained from our tax solicitors, TNB has a good basis to contend that there is no legal and factual basis for IRB to issue the said notices” “Accordingly, TNB will be appealing against the ...

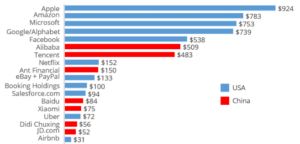

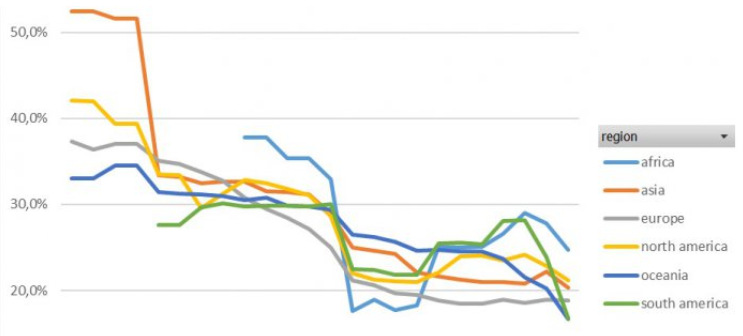

Unilateral Measures related to taxation of the Digital Economy

Imposed and proposed unilateral measures to adress taxation of the Digital Economy CountryMeasurePercentageDecriptionEffective data Czech Republic DST (Law on selected digital services tax)The Czech Ministry of Finance submitted a finalized proposal to the Czech Government on Sept. 5, 2019, which is now pending the Czech Parliament’s approval. Effective date: to be determined, but likely sometime in 2020. January 18 - The Czech government approved a 7% digital tax proposal on Monday aimed at boosting state coffers by taxing advertising by global internet giants like Google and Facebook, the Finance Ministry ...

/ Disputes and Settlements, Hearings and Investigations, Limited Risk Distributor, Tax Havens and Harmful Tax Practices, Transfer Pricing News

Microsoft – Taxes and Transfer Pricing

Microsoft’s tax affairs have been in the spotlight of tax authorities all over the World during the last decade. Why? The setup used by Microsoft involves shifting profits from sales in the US, Europe and Asia to regional operating centers placed in low tax jurisdictions (Bermuda, Luxembourg, Ireland, Singapore and Puerto Rico). The following text has been provided by Microsoft in a US filing concerning effective tax and global allocation of income: “Our effective tax rate for the three months ended September 30, 2017 and 2016 was 18% and 17%, respectively. Our ...

US response to OECDs Unified Approach

Letter from the US treasury to the OECD concerning the proposed Unified Approach on taxation of the Digital Economy, and the reply to the letter from the OECD ...

Netflix under investigation for alleged tax evasion in Italy

Public prosecutors in Italy have opened a preliminary probe into the taxation of Netflix on the basis that servers and cables constitute a digital infrastructure that makes revenues taxable under Italian law. Italian media, Corriere della Sera, says that the prosecutors are working with Italy’s fiscal police to determine whether revenues from Netflix’s estimated 1.4 million Italian subscribers are subject to Italian taxation, even though Netflix operates out of the Netherlands. Italian prosecutors have recently also probed into the taxation of other U.S. tech giants such as Apple, Amazon and ...

British American Tobacco hit by £902 million tax assessments in the Netherlands

According to the 2018 financial statement, British American Tobacco group has been hit by a £902 million tax assessments in the Netherlands. “The Dutch tax authority has issued a number of assessments on various issues across the years 2003-2016 in relation to various intra-group transactions. The assessments amount to an aggregate net liability across these periods of £902 million covering tax, interest and penalties. The Group has appealed against the assessments in full. The Group believes that its companies have meritorious defences in law and fact in each of the above matters ...

The L’Oréal group announced additional payment of 320 million euros in corporate tax to the French tax authorities to “settle a dispute”

The French cosmetic group L’Oréal announced in September 2019 that it would pay 320 million euros to the French tax authorities to “settle a dispute” related to the payment of corporate tax for three of its subsidiaries for fiscal years 2014 and 2018. In detail, the charge was 47 million euros for Lancôme Parfums et Beauté, 115 million euros for Active International Cosmetics and 158 million euros for Prestige and Collections International ...

2019: ATO draft on compliance approach to the arm’s length debt test

The draft Guideline provides guidance to entities in applying the arm’s length debt test in Division 820 of the Income Tax Assessment Act 19972 and should be read in conjunction with draft Taxation Ruling TR 2019/D2 Income tax: thin capitalisation – the arm’s length debt test. This Guideline also provides a risk assessment framework that outlines our compliance approach to an application of the arm’s length debt test in certain circumstances that are identified as low risk. The arm’s length debt test is one of the tests available to establish ...

France, Public Statement related to deduction of interest payments to a Belgian group company, BOI-RES-000041-20190904

In a public statement the French General Directorate of Public Finance clarified that tax treatment of interest deductions taken by a French company on interest payments to a related Belgian company that benefits from the Belgian notional interest rate scheme. According to French Law, interest paid to foreign group companies is only deductible if a minimum rate of tax applies to the relevant income abroad. Click here for translation ...

Telenor will have to pay additional taxes of 2.5 billion Norwegian crowns

Telenor Norway has received a tax assessment according to which the company will have to pay additional taxes in Norway of 2.5 billion Norwegian crowns for tax year 2013. A deduction expenced in 2013 for a loss suffered in 2012 due to settlement of bank guarantees given in respect of external funding in its Indian subsidiary Unitech Wireless has been disallowed for tax purposes by the Norwegian Tax Authorities Telenor decided to enter the market in India in 2008. In 2012, the Supreme Court of India revoked the licenses of ...

The Australian Taxation Office and Mining Giant BHP have settled yet another Transfer Pricing Dispute

BHP Group has agreed to pay the state of Western Australia A$250 million to end a dispute over royalties paid on iron ore shipments sold through its Singapore marketing hub. The State government found in January that the world’s biggest miner had underpaid royalties on iron ore shipments sold via Singapore stretching back over more than a decade. BHP reached a deal to pay A$529 million in additional taxes to the Australian government late last year to settle a long-running tax dispute over the miner’s Singapore hub on its income ...

Poland issues Tax Explanations on Transfer Pricing – No. 1: Comparability Analyses and Transfer Pricing Documentation

18 June 2019 the Polish Minister of Finance issued the first explanations on transfer pricing concerning – technical aspects of preparing comparability analyses and transfer pricing documentation. With regard to the technical aspects of preparing comparability analyses, the explanations cover such detailed issues as: data comparability vs. locality feasibility of using internal data feasibility of using bid data the appropriateness of using comparables that are not publicly available (so-called secret comparables) reasonableness of discarding from the comparables sample entities with extreme results (including those with loss) minimum sample size for ...

June 2019: IRS Transfer Pricing Examination Process – Risk Assessment

The report on Transfer Pricing Examination Process (TPEP) provides a framework and guide for transfer pricing examinations. The guide will be updated regularly by the IRS based on feedback from examiners, taxpayers, practitioners and others ...

Czech Republic Issues new 2019 Local Transfer Pricing Instructions GFR D-34

May 2019 the Czech Republic issued new local transfer pricing instructions D-34. These new instruction replaces the 2011 Instruction D-334. Simultaneously with the new instruction, the Czech translation of the OECD Guidelines on Transfer Pricing for Multinational Enterprises and Tax Administrations, as amended in the 2017 version, was also published in the Financial Bulletin of the Ministry of Finance No. 5/2019. Click here for unofficial English Translation Click here for translation ...

Perrigo facing billion dollar tax assessments in both Ireland and the US

In July 2013 the Irish pharma company Elan was acquired by the US based Perrigo group for $8.6 billion (£5.6 billion). Ireland’s corporation tax rate was one of the main attractions for Perrigo and the deal was said to give Perrigo substantial tax savings due to a corporate tax inversion. The Irish 12.5 % corporate tax rate compared US rate of 30 % was further augmented by the trading losses built up over a number of years by Elan in its business as a drug development group. That meant that even ...

The Kering Group – owner of Gucci, Bottega Veneta, Saint Laurent and Pomellato – has settled an Italian Tax Case for an Amount of 1.250 Billion Euro

The Kering group – owner of Gucci, Bottega Veneta, Saint Laurent and Pomellato – has settled a case with the Italian tax agency for an amount of euro 1.250 billion in taxes and penalties relating to fiscal years 2011-2017. The case was started by the Italian tax police in 2017 and resulted in a recommendation to charge the president and chief executive officer of the Italian company Guccio Gucci S.p.A. with the crimes of tax evasion and failure to file Italian income tax return. Guccio Gucci S.p.A., the Italian operating ...

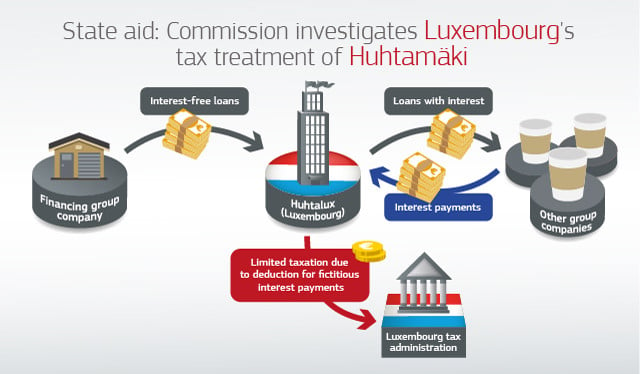

European Commission decision to open state-aid investigation into Luxembourg deduction of deemed interest on interest free loans – The Huhtamaki

The European Commission has published a non-confidential version of the decision to open a state aid investigation into tax rulings granted by the Luxembourg tax authorities to the Huhtamaki Group in relation to the treatment of interest-free loans granted by an Irish group company to a Luxembourg group company, Huhtalux S.a.r.l. The investigation will focus on three rulings obtained by a Luxembourg subsidiary of a group from the Luxembourg tax administration in 2009, 2012 and 2013. The Luxembourg subsidiary which carried out intra-group financing activities was granted interest-free loans from an ...

Facebook in billion dollar dispute with the IRS related to transfers of intangibles to Ireland

In the annual report for 2018 Facebook Inc. has included the following statement on current tax disputes with the IRS. “…The tax laws applicable to our business, including the laws of the United States and other jurisdictions, are subject to interpretation and certain jurisdictions are aggressively interpreting their laws in new ways in an effort to raise additional tax revenue from companies such as Facebook. The taxing authorities of the jurisdictions in which we operate may challenge our methodologies for valuing developed technology or intercompany arrangements, which could increase our ...

Western Digital in $549 million transfer pricing dispute with the IRS

Western Digital has been issued a $549 million tax assessment for fiscal years 2008 – 2012 by the IRS relating to transfer pricing with the Company’s foreign subsidiaries and intercompany payable balances. In the Annual Report for 2018 the following is stated by Western Digital on the case: “The Internal Revenue Service (“IRS”) previously completed its field examination of the Company’s federal income tax returns for fiscal years 2008 through 2012 and proposed certain adjustments. As previously disclosed, the Company received Revenue Agent Reports from the IRS for fiscal years ...

EU report on financial crimes, tax evasion and tax avoidance